EchoNet: considerations for the economy of a decentralized network

Dominic Wallis Ph.d, Christian Koch M.A.

Abstract

The following will seek to assess the economic implications for Orcfax as it continues research and development into maturing its decentralized network of validator nodes, known as EchoNet, through the integration of staking and consensus mechanisms. Where necessary, specific considerations relating to staking and consensus in terms of economic impacts or their requirements will be addressed separately, however the two mechanisms share considerable overlap in both areas; for this reason, unless addressed separately, the following applies to both.

1. Context

A decentralized service is a service provided by a set of separate autonomous participants that are not subject to a hierarchy. Within the network of participants, the majority share the common purpose of providing a good service. However, some participants may be incompetent or even have malign intent. Because of this possibility, each is suspicious of the others. This network of mutually suspicious participants must coordinate the running of a distributed service. Orcfax endeavors to develop such a system in order to migrate its current mainnet oracle services to a fully decentralized solution for Cardano.

Part of an overall design of such a system is providing tooling which enables them to reach agreement over various network related tasks; this is consensus. The design must also ensure that participants in that process are rewarded for the good service they provide and are strongly discouraged from behaving badly; staking is the term we use to encapsulate the process governing this aspect of a decentralized service.

2. Use cases

The number of projects which may benefit from the deliverables coming out of the f12 proposals pertaining to consensus and staking are numerous; this is because the deliverables are useful for any project which desires to move complexity off the L1 and requires a set of participants to provide a service, on behalf of the project, in a decentralized manner.

It's easy to imagine projects which might wish to build upon existing web2 services and to make them more publicly transparent, or their records more secure, by decentralizing them. A decentralized weather forecast service, flood insurance claims, digital gambling, and verified sports scores could be meaningfully improvised by a network of participants that were responsible for corroborating their data prior to leveraging it on the L1; many could also decide that those with the ability to corroborate data with financial value, need to stake something of value themselves in order to deter bad behaviour. The users or consumers of such service would benefit from increased protection against erroneous data, improperly executed transactions, and they may feel more secure in the knowledge that bad actors are financially impacted by their actions.

The incorporation of either of these components by other projects would also mark their commitment to decentralization and the desire to increase overall transparency, both of which are valued qualities among the Cardano community.

The number of potential use cases are numerous and as projects on Cardano continue to innovate, the number will continue to increase. Knowing this, the design of the consensus and staking proof of concepts continue to be executed in such a way that while in context of this proposal, the service provision is an oracle, it need not be and could be applied to many other project use cases as these mechanisms are primarily off-chain. It being our hope that this modular approach should allow for greater integrator flexibility across use cases.

Each PoC also black-boxes the other, so while the Orcfax use case will utilize both a staking and consensus mechanism, others may choose to leverage them independently. Our team has elected to design these PoC's in this fashion because we understand that The deliverables from these projects have broad utility and may be used by projects offering diverse services to their users.

2.1 Specific considerations for Staking

Projects assessing the implementation of a decentralized network may assume that most participants will be honest and competent, and that they will continue to participate honestly and with competence providing participation is straightforward and financially neutral. However, they are without hierarchy or a priori obligation to provide this service or cooperate with one another.

This is why the output system must provide the incentive structure that, under these assumptions, will result in the expected service.

A participant's behaviour is accounted for: good behaviour that aids the quality of service provision is measured, as is bad behaviour. We can assume that the participants are able to reach consensus on these accounts and produce a signature/signatures as proof of general acceptance. This happens periodically - say once every 24 hours.

The rewards for good behaviour and service are paid out from a 'treasury' and forfeit funds are paid to the treasury. The currency will be a native asset. The project output should include the scripts governing these aspects of the treasury. For use cases beyond an oracle service, we will assume the treasury is sufficiently funded to meet the burden of conveying rewards. More details regarding the Orcfax specific use case and the treasury from which we will pay rewards will be covered in a later section.

3. Orcfax staking: rewarding good behaviour

Orcfax is an aspiring decentralized Oracle service. To participate within the network, a participant must be in possession of two types of Cardano native assets:

- One Orcfax Validator License, one of 100 NFTs

- At least 500,000 $FACT

Participants are strongly discouraged from behaving badly through the use of slashing. A participant must first put 'at stake' some asset(s). If the participant's actions are deemed bad, some or all of their assets are forfeit through a slashing mechanism.

To incentivize good behavior, a participant receives rewards proportionate to their good service.

However, when balancing incentives and penalties for participants, care must be taken. The wrong incentive structure may either:

- cause a race to the top. Rewards only go to a few participants. Eventually this leads to centralization which degrades robustness.

- cause a race to the bottom. Participants are rewarded even if they are poor service providers.

Both are bad for the long term health of the service.

3.1 Staking components overview

The following are the key components of the consensus PoC:

- Constitution - holds the signing key.

- Hold - rewards awaiting collection.

- Safe - locks a participants funds.

- Treasury - holds funds awaiting dispensing.

- Dispenser - manages the dispensing of rewards.

The following sections will be updated to reflect final design decisions made in milestone 3.

3.1.1 The Constitution

The constitution holds any dynamic data required by the protocol. This is a simple, classic design consisting of a multipurpose script with spend and mint purpose. The script is seeded so that it can only be initiated once.

A validity token (NFT) is locked at the script, its utxo's inlined datum contains the pubkey. It can be spent only if the pubkey signs the transaction.

If the tokens are not burnt in the transaction, then the validity token must be output to the same address.

3.1.2 The Safe

The safe holds participants' funds. These are at risk if the participant is deemed to behave badly. It is also required to claim rewards.

A participant locks funds in (an instance of) a safe. While it exists, it is represented on the L1 tip by a single utxo.

This is the basic lifecycle of a safe.

First, participants take part in a decentralized key generation (DKG) process. The output of the DKG is one key pair for each participant as well as a single collective pubkey. The signature generation procedure requires multiple coordinated rounds. We'll call this the 'signature dance'. The output of the signature dance is a single signature. On-chain verification of the signature with the collective pubkey is indistinguishable from that of a 'vanilla' signature.

We may assume that off-chain, the participants are able to organise a DKG, and will organise FROST style signing of the rewards and slashing data. Each individual pubkey can then be used to identify the participant. The collective pubkey is used to verify the signature.

If the participant is satisfied with the DKG step they perform a lock step.

This initialises the safe. It is now Locked with the owners keys in the datum.

While Locked the owner may update the safe with new keys.

If the participant wishes to no longer participate, they renounce. The safe is

now Renounced.

All participants should be watching the chain for renounce actions, as they

should no longer accept signatures associated with the renouncer. The renounce

begins a limited period of time where the other participants can still apply

penalties.

Once this time period has elapsed, the participant may free their locked

funds. All funds are again at the participants disposal.

If sufficient participants deem a participant with either a Locked or

Renounced safe to have acted badly, they can produce a slash transaction. This

empties the contents of the safe into the treasury. The script ensures this is

permitted only when signed by the constitution.

3.1.3 The Hold

The Hold is a simple script which "holds" rewards until they are claimed.

A utxo at the Hold address has an inline datum indicating to which safe owner

it belongs.

3.1.4 The Dispenser

The dispenser facilitates the dispensing of rewards to the Hold.

4. Orcfax validators: reaching L2 consensus

The economics of consensus look quite different. The focus here is in understanding the cost of validator participation, the cost to a validator when slashed, and the potential benefits of performing maliciously. If the potential profit of providing bad information outweighs the cost, validator nodes become financially incentivized to act badly, which would result in significant risk to network integrity.

The mechanics of slashing is covered in The Safe. For this section, all that is relevant is that malicious activity results in the loss of participants' stake; whether the loss is entire or a portion is undecided and will likely depend on the ability to define a spectrum of bad behaviour in code. For the purposes of this section, we will assume that being slashed results in the entire loss of participants' stake.

At the time of this writing, the cost of acquiring 500,000 FACT tokens is approximately 5,025 ADA or 5,577 USD. The floor price for a Orcfax Validator License is 10,500 ADA or 11,653 USD. This means that the cumulative stake required to participate has a value of approximately 17,230 USD.

In order to combat the risks associated with validators having financial incentive to act badly, Orcfax is tasked with devising a strategy by which malicious behavior becomes cost prohibitive or disadvantageous. Put another way, the total cost incurred to the bad actor for their behaviour must be greater than the reward they might receive by undermining the system; to use the example of a loan liquidation, the cost of operating the number of nodes necessary to submit erroneous data, which would result in the liquidation of a target loan, must cost more than the liquidation would reward the bad actor. It is this cost relationship which makes malicious actions disadvantageous.

At this stage of research and development, Orcfax has not yet decided on the process through which consensus will be reached over a given fact statement; the different ways this might be orchestrated have implications on how malicious behavior may need to be addressed. For this reason, we will explore two options: 1.) where one node proposes a statement, and a subset of the 100 nodes within the network verifies that statement; 2.) where all nodes within a randomly selected subset propose a statement, and the median entry is selected.

In the first, where a proposer has their statements verified by a subset of nodes, the cost of the lie (using the values given above) becomes USD. So, in a system where the threshold for verification was 10 nodes, the cost of the lie is more than 170,000 USD.

However, if instead of requiring any subset for verification we had the nodes selected at random, then the lie becomes significantly more expensive. With random selection of subset nodes, even If the bad actor corrupted 10 of the total 100 nodes, it still becomes very unlikely that those 10 would be randomly selected.

In the second scenario where a subset of nodes is randomly selected, each proposes a statement, and the median is selected, the cost of the lie at a minimum is USD or the value of half the selected nodes +1. So in a case where, from 100 nodes, a subset of 21 are selected at random, the cost of the lie would be nearly 190,000 USD.

But again, the fact that this subset of nodes is selected at random means that these costs are the minimum. Even with a bad actor having at least 11 licenses, and the corresponding $FACT, the probability of them all being selected to propose within the subset is very slim.

For either of the above scenarios, the value of $FACT and cost of acquiring a Validator License have immense impact on the appropriate size of the subset of nodes; it could very well be that, using the values given previously, it's necessary to select a subset of 21 (or more) nodes in order to adequately reduce the risk of bad actors and to make bad behaviour cost prohibitive. However, this narrative dramatically changes should $FACT halve in value, or increase 10x.

These are all considerations that Orcfax must weigh as we continue to develop a consensus solution, especially whether not to incorporate randomness (and how). These choices will be finalized in the next milestone when development begins.

This section will be updated to reflect final design decisions made in milestone 3.

4.1 Probability of selection

In the previous section we speculated as to the total cost for an attacker to secure all of the nodes necessary to publish erroneous data. In this section we will investigate the probability of those corrupted nodes being selected to reach consensus over a given statement.

The first example was of a proposer which has their statement verified by a subset of 10 nodes. The probability of having a specific combination of nodes (i.e. the 10 corrupted nodes) selected can be determined using the following formula:

Where , pronounced "n choose r," is the number of ways to choose from . In the specific use case of Orcfax, represents the number of ways to choose 10 individuals from the 100 total nodes () without regard to order.

This can be represented as:

- : The factorial of 100, representing all possible arrangements of 100 nodes.

- : The factorial of 10, representing the arrangements of the selected 10 nodes.

- : The factorial of 90, representing the remainder of arrangements after the removal of permutations.

Thus, the probability is:

This gives the probability of a specific set of 10 nodes being selected from a total of 100 nodes, which is

In the second example where a subset of nodes is selected, each proposes a statement, and the median is selected, the bad actor needs 11 of their corrupted nodes to participate in consensus in order to ensure that 10 of their nodes will make the 11th the median.

The probability of their 11 nodes being selected within a subset of 21 nodes can be expressed in the following equation:

- : The number of ways to choose all 11 of the corrupted nodes (this is 1, as there's only one way to choose all 11 of them).

- : The number of ways to choose the remaining 10 nodes from the remaining 89.

- : The total number of ways to choose 21 nodes out of the total 100.

Thus, the probability of all 11 corrupted nodes being selected within a subset of 21 nodes is approximately:

This section is for purposes of illustration only. Specific design choices to be made in milestone 3 can have significant impacts on how randomness is implemented and thereby the probable chance of a bad actor being able to influence consensus.

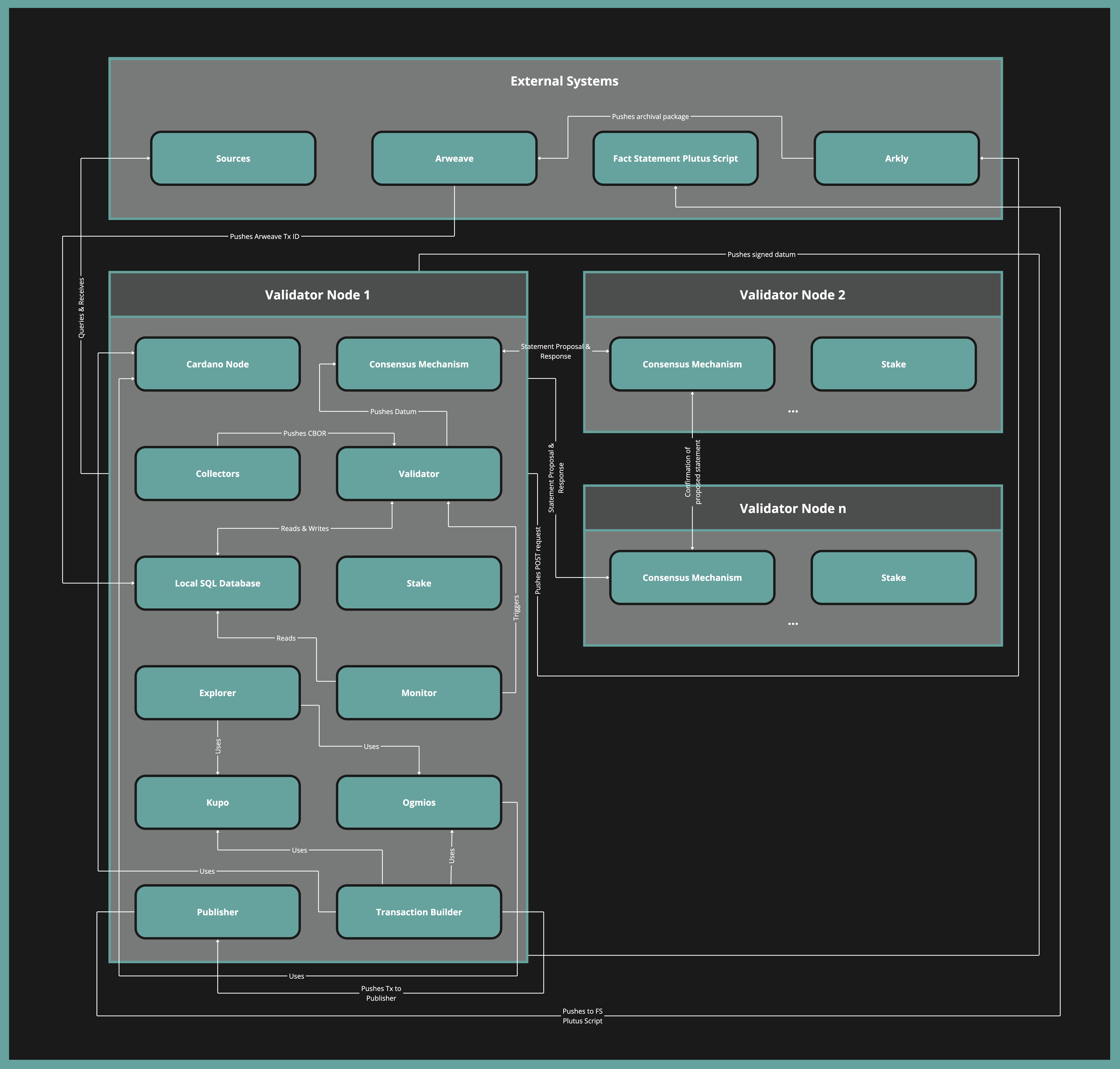

4.2 Contextualizing consensus components

The following demonstrates the various components of a fully decentralized node within the EchoNet network; "Validator Node-1" shows each of its components whereas "Validator Node-2" and "Validator Node-n" have been abbreviated in order to highlight the staking requirements and the connections to each nodes through the consensus mechanism. The diagram also unpacks the relationships between components and how they are expected to operate.

5. Participation costs

Participants will need to shoulder the cost of either acquiring their own equipment by which they will participate in the network, or the cost of maintaining a subscription to cloud infrastructure. While the cost of implementing the software responsible for consensus and staking is unknown at this time, the current cost of running a mainnet node within the Orcfax federated network is approximately 200 USD per month, which should serve as a basic understanding of costs for network participants; it's important to understand that this approximation of cost is an estimate and may not reflect the total cost of participation for validators.

The cost of implementing and running staking and consensus mechanisms remains unknown because design choices relating to either can have significant impacts; final design takes place in the next milestone. This section will be updated after the next milestone and the completion of the PoC's.

6. Rewards

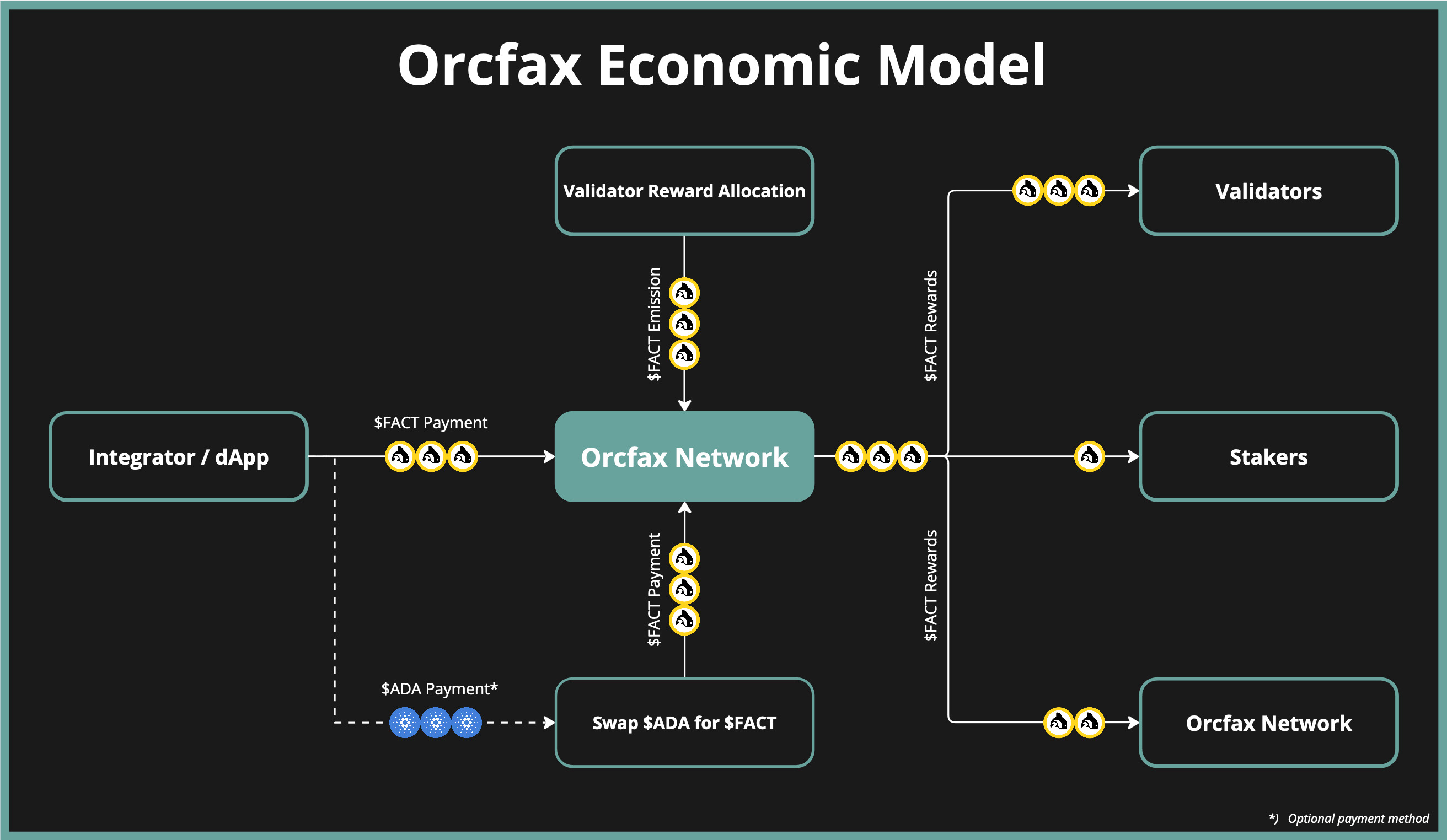

Early on in Orcfax development, Orcfax established the mechanisms by which Validators would be onboarded and rewarded for their participation in the network. Our tokenomics ensured that the biggest allocation of $FACT was reserved to reward our decentralized validators for running Orcfax nodes.

During early stages of the Incentivized testnet, and integration of Staking and Consensus mechanisms, we can assume that there may be a relatively low number of integrators. Because of this, validators will be rewarded for their participation in the network with $FACT from the Validator Rewards Allocation (hereafter referred to as the "treasury"), which contains 50% of the total FACT token supply, or 500,000,000 (50%) $FACT. It can also be assumed that the value of $FACT will be impacted by the number of integrators so that as integrators increase, the value of the $FACT emissions from the Orcfax treasury will also increase.

An increase in the number of integrators which request and consume Orcfax statements will lead to more publications; as these integrators buy $FACT in order to complete these transactions, the demand for $FACT and its value will increase thereby creating a positive feedback loop.

The following demonstrates this positive feedback loop and how having integrators pay for feeds in $FACT (or ADA) creates positive buy pressure for $FACT. The generated $FACT payments from integrators are then distributed to entities crucial for network operation like Orcfax Validators.

Consumers will also be able to fund their desired feeds with ADA, but Orcfax will sell these funds for $FACT so as to have the same result.

SO while in the beginning, validators will be compensated from the Orcfax treasury, as the $FACT payments generated from integrators outpaces $FACT emissions from the treasury, Orcfax will be able to transition to compensating validators with revenue from these transactions.

This means that the amount of FACT tokens rewarded from the treasury per publication will decrease over time as the fees from transactions increase; the increasing $FACT payments to validators from these transactions will compensate for the reduced emission from the treasury, and will eventually replace them completely.

The above is demonstrated in this model which allows for the manipulation of key variables such as the value of ADA in USD, the value of $FACT in ADA, the number of integrators the network services; what results is a projection as to the rate of treasury emission, the value of those emissions, and how they will be paid out to validators and Orcfax over time. The far right column breaks down what percentage and what value these emissions are projected to have.

Graphs have also been added which demonstrate how these variables and the emission rate decreases over a 10 years span; The economic model depends on the critical assumptions identified previously: that the number of integrators will increase over time, that the value of $FACT will increase as integrators increase, and that this happens before treasury emissions are unable to sustain the network.

The right side of the model also shows how Orcfax will pay itself during this period. Of the emissions from the treasury, go to Orcfax, and of the integrator transaction fees (while still executing emissions from the treasury), goes to Orcfax. This combination means that Orcfax can fund its operations over the course of the 10 year period with as few as paid feeds while supporting subsidized feeds.

This is possible in large part because Orcfax has been designed in such a way that the cost of running the Orcfax network in the federated model is relatively modest at less than 10,000 USD monthly; these costs allow the team to maintain redundancy, test environments, and support development. The low cost of the network also means that Orcfax operation can continue well into the future even with modest success in selling its oracle feeds.

With that said, our team anticipates that these costs will decrease over time as validators continue to absorb the tasks and roles currently held by Orcfax. In the fully decentralized network, the costs of running the network will be entirely shouldered by the network.

Orcfax is cognizant that the widespread adoption of Orcfax services could take time-- the model takes this possibility into account and demonstrates how the significant allocation of $FACT to the treasury allows Orcfax to meet the burden of paying validators and itself even if the value of $FACT is volatile.

7. Beyond the PoC

While research for both consensus and staking was completed within budget, systems analysis and development have, to date, exceeded initial estimates; this has largely been due to complexities which while foreseen, their scope was not entirely appreciated. The difference between the budget and actual costs is being covered by Orcfax.

Going forward, the reality of these cost discrepancies is useful for better understanding the real cost of any work which may be needed after the successful completion of catalyst closeout to move both the consensus and staking PoC’s towards mature software and beyond with the integration of consensus and staking mechanisms into EchoNet.

These two proposals shared similar funding models during F12; both anticipated approximately 375 hours for completion. Based on the research completed through each of the proposals and the limited start made in the development of their proof of concepts to date, our team projects that it will likely require a development team of equivalent size, an additional 9 months or 1400 hrs to: 1.) mature the PoC's to software for mainnet integration; 2.) provide sufficient integration testing. These hours would likely maintain a similar split between developers and system analysis/documentation as the f12 proposals if seeking funding through catalyst.

These estimations are based on early stage understandings which may change during development in milestone 3. A goal of the project is of course to better understand these costs as development continues.