FACT tokenomics

The FACT utility token has a fixed supply of 1 billion tokens.

The FACT token minting policy ID is a3931691f5c4e65d01c429e473d0dd24c51afdb6daf88e632a6c1e51.

The FACT token is tradeable on Cardano DEX markets. It is listed on coin tracking sites like CoinGecko and CoinMarketCap.

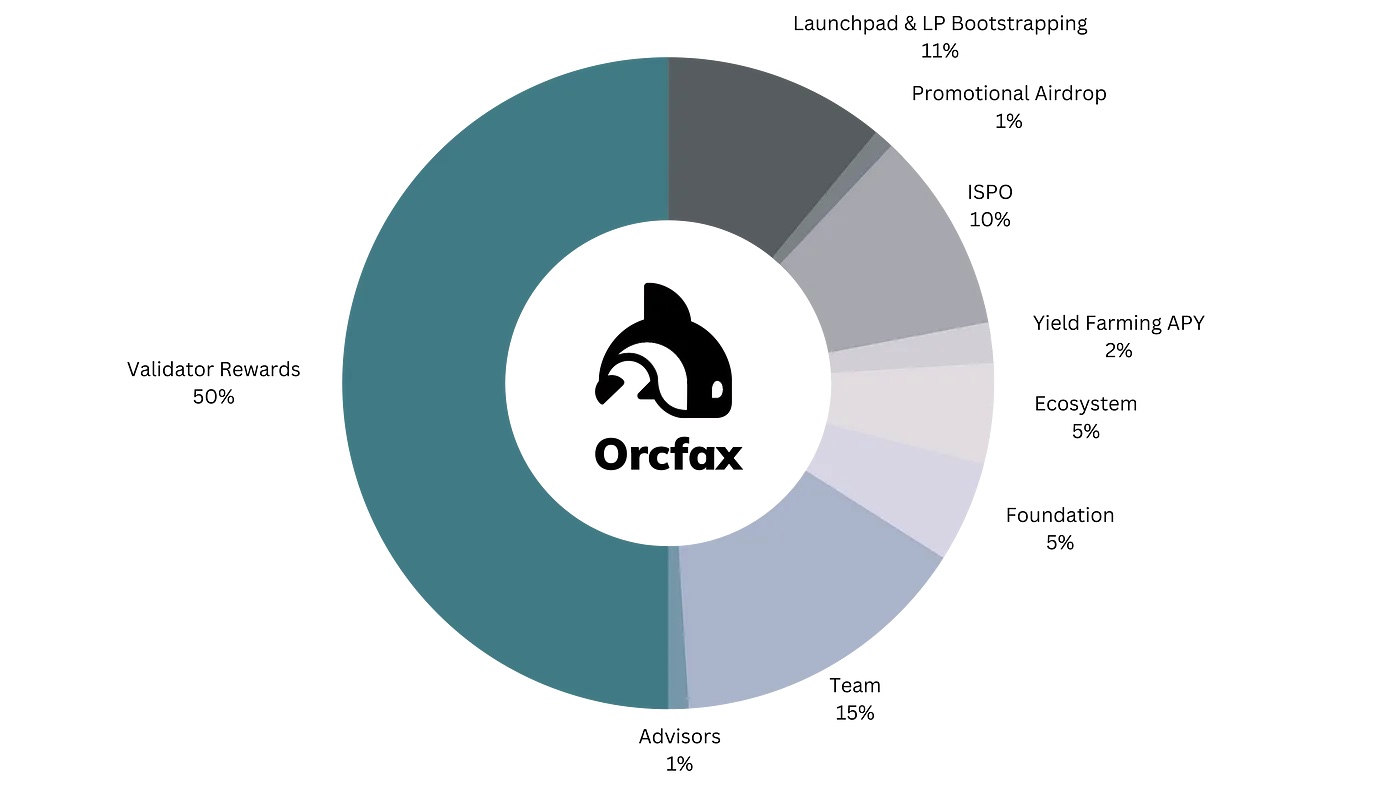

Token distribution

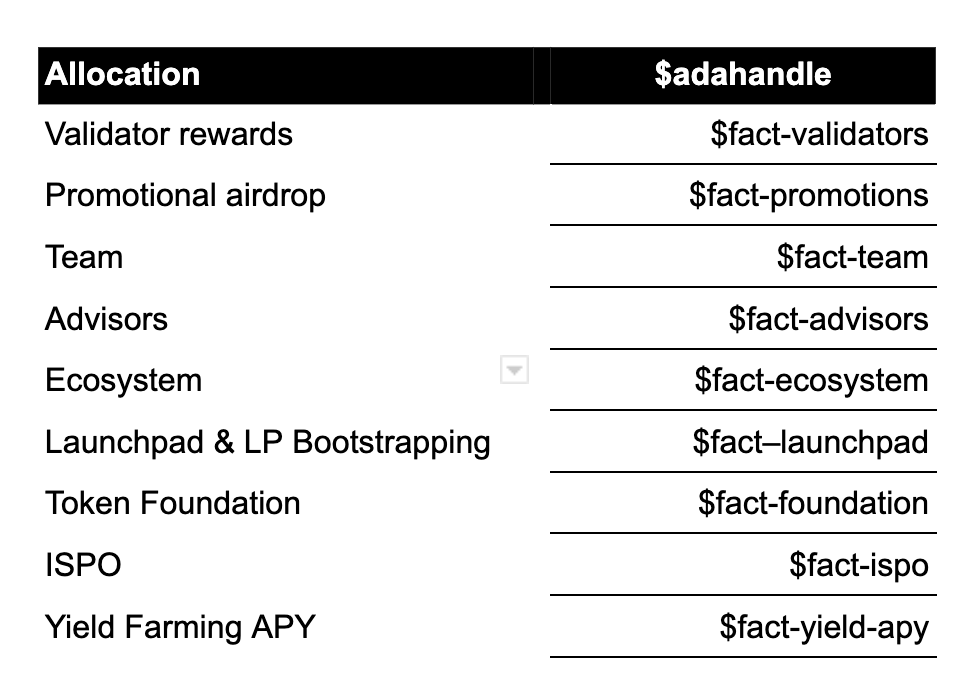

Following the token generation event (TGE), the Orcfax team distributed all 1,000,000,000 $FACT to a series of ADA Handle wallets. Each of these adahandle wallets represents one of the allocations as mentioned in the chart below.

To further understand these allocations, each will be defined, with their purpose and use expanded on; the following list of ADA Handle wallets correspond to the allocations in the $FACT tokenomics pie chart above. The ability for users to monitor the use of these ADA handles, combined with the wallets' strict parameters for use, provides a unique method of accountability which the Orcfax project hopes to foster. This is accomplished by ensuring a high level of transparency in the distribution and use of $FACT as any member of the Cardano community can monitor activity within these wallets.

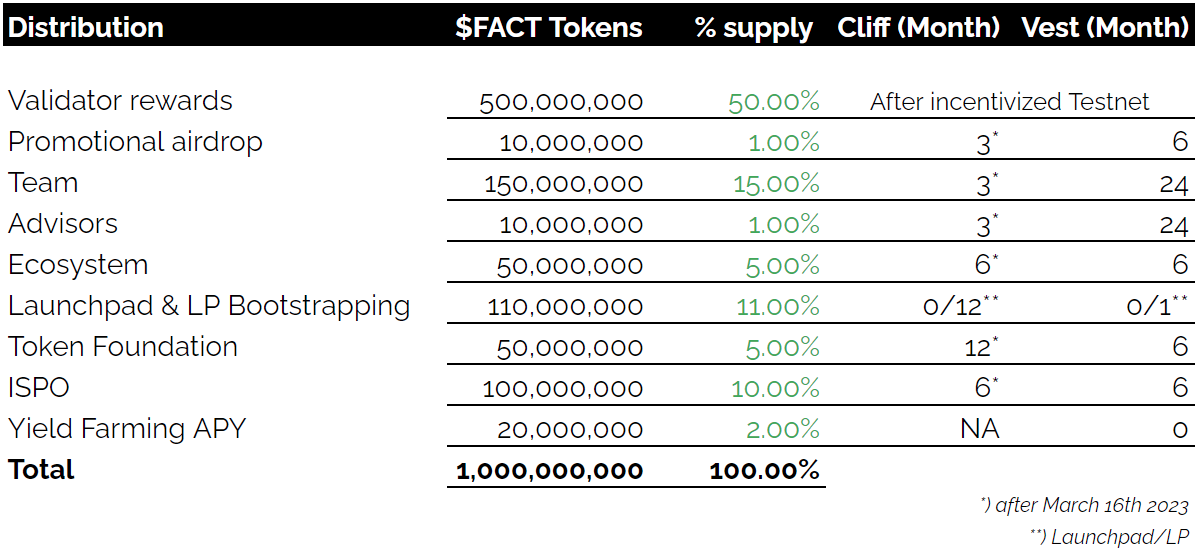

As mentioned previously, each of the nine $FACT allocations has rules governing how and when their supply of $FACT can be utilized. The vesting schedule provided in table above clearly presents the total $FACT allocation for each ADA Handle, the cliff date, and when that supply is made available to the allocation.

Validator rewards

The biggest allocation is reserved to reward our decentralized validators for running Orcfax nodes.

500,000,000 (50%) $FACT have been allocated for rewarding Orcfax validator node operators for collecting, normalizing, validating, publishing and archiving real-world data for consumption as eUTXO datum by Cardano dApps and smart contracts.

This allocation is meant to subsidize operations long enough for the network to become self-sustaining based on fee collection. This allocation is a serious signal that Orcfax understands that a healthy validator network is required for the long-term viability and value of the network.

This allocation does not have a cliff date or vesting schedule. How it is paid out to validators will be made public after the close of the Orcfax Incentivized Testnet.

Promotional airdrops

10,000,000 (1%) $FACT have been allocated for raising awareness for our project and to promote Orcfax. This will be done by utilizing the allocated tokens by way of $FACT airdrops and giveaways. The project will also leverage this allocation in various public relations campaigns going forward.

This allocation has a cliff date of 3 months after the start of the ISPO and a 6 month vesting period (i.e. after 3 months, distributed monthly for 6 months).

Team

150,000,000 (15%) $FACT have been allocated for disbursement among the founding team; this allocation will be distributed to the founder and team members in order to compensate them for their significant investments, both in time and effort to launch the Orcfax Network.

This allocation has a cliff date of 3 months after the start of the ISPO and a 24 month vesting period.

Advisors

10,000,000 (1%) $FACT have been allocated for external advisors that provide guidance and support to the Orcfax project with specialized expertise. These advisors will be compensated in $FACT from this allocation.

This allocation has a cliff date of 3 months after the start of the ISPO and a 24 month vesting period.

Ecosystem

50,000,000 (5%) $FACT have been allocated for developing future partnerships, marketing campaigns, developer grants, funding research, and for tools that contribute to the project's overall ecosystem.

This allocation has a cliff date of 6 months after the start of the ISPO and a 6 month vesting period.

Launchpad & LP Bootstrapping

Orcfax used the Wingriders Launchpad to introduce the FACT token to the open market and make it available for circulation. this was done to raise funds for continued project development via a decentralized and non-custodial process. Decentralized, non-custodial, and fair price discovery were critical aspects of the Orcfax launch. This is why we refrained from utilizing a centralized initial coin offering (ICO) style public sale. By doing so, we empowered the market to set the token's initial price, avoiding pre-determined prices, promotes decentralization strategies, and provided an opportunity for the initial bootstrapping of a liquidity pool. Additionally, this approach also enhances regulatory clarity and minimizes future risks.

86,000,000 (8.6%) $FACT was allocated as collateral for ADA contributed by Launchpad participants. 24,000,000 (2.4%) was allocated for bootstrapping the first liquidity pool on the Wingriders DEX which followed the launchpad.

The 86,000,000 Launchpad $FACT have no cliff and/or vesting restrictions. They can be claimed in full as soon as the launchpad closes.

Orcfax is committed to increasing the footprint of its community. The way we decided to distribute the Orcfax utility token is an important step towards achieving this goal. That's why we decided not to sell any FACT tokens via VC, seed, or private sale rounds. We believe this has resulted in a more fair distribution of our token among our community.

Token foundation

50,000,000 (5%) $FACT have been allocated for use in developing and the subsequent launch of the Orcfax DAO. The allocation will also be utilized to seed the initial treasury, which will be used by the Orcfax DAO foundation to fund ongoing activities.

This allocation has a cliff date of 12 months after the start of the ISPO and a 6 month vesting period.

ISPO

100,000,000 (10%) $FACT were allocated for use in the Orcfax Initial Stake Pool Offering (ISPO). An ISPO is a mechanism popular within the Cardano blockchain community. The basic principle is that ADA delegators forgo their ADA staking rewards each epoch in return for a proportionate share of a project's token.

The Orcfax ISPO started on March 15th 2023, within Cardano's 400th epoch. The Orcfax reflection on the process was made available to the public on July 7th, 2023.

As the ISPO approached its saturation point in epoch 405, Orcfax closed the pool for new delegators, and the ISPO came to a close in epoch 413. The speed at which the Orcfax ISPO reached saturation, and came to a successful close, made it one of Cardano's most successful ISPOs at that time.

The Orcfax ISPO was the first and only way for our early supporters to acquire $FACT by delegating ADA to our ISPO pool.

The cliff date for the first ISPO drops was September 2023, with 10% of the total $FACT supply allocated to ISPO participants. This allocation had a cliff date of 6 months after the start of the ISPO and a 6 month vesting period.

Yield Farming APY

20,000,000 (2%) FACT tokens were used to enhance the appeal of our liquidity pool(s) by offering substantial yield farming rewards to our liquidity providers.

Yield farming, also called liquidity mining, involves lending or staking cryptocurrencies in DeFi platforms to earn extra tokens. Instead of letting tokens sit idle in their wallets, users can deposit tokens in DeFi platforms like WingRiders, or Minswap. In return, users receive (native) tokens or other fees as rewards. Rewards vary based on factors like asset type, amount, duration, and platform demand.

The tokens received by users as a reward for their staked $FACT have no cliff and/or vesting restrictions.

Disclaimer

Orcfax does not offer financial advice. The information provided above is for educational and informational purposes only. Yield farming involves financial risks, and individuals should carefully consider their own financial situation, risk tolerance, and investment goals before participating in any yield farming program.